Blog Archives

“TRICK OR TREAT”

It is here the time of the year where fear is in the air “Mwahahahaahhaha”. So many little boys and girls fear this holiday in-particular because of the goons, goblins, monsters and ghost. Now as kids we might have feared a few of these creatures but as an adult we come to the realization that outside of our imagination, none of these creatures actually exist.

What is fear?

Fear is:

False

Expectations

Appearing

Real.

“Fear” – is defined in the dictionary as:

“…an unpleasant, often strong emotion caused by anticipation or awareness of danger…implies anxiety and usually the loss of courage.”

Now lets look at fear as it applies to traders in the market. All to often traders find themselves acting on emotion and impulse based off of the fear of losing money or being wrong, which in most cases results in a loss anyway when trading against your plan. Trading the markets can be a daunting task for the novice trader.

The fear of loss can keep a trader from executing a trade. Or it can keep him from exiting a trade when his trading plan calls for it. Either can be costly. No one likes to have losses, but even the very best traders do. The key is to realize that you are worrying about the results of “that” trade, and not concentrating on executing your plan, which over time will make you successful.

In closing, “successful” market traders profit off the “fears” of the majority of other traders. How you might ask? They do this by “sticking to their plan” and not allowing their emotions (fears) to rule their decision making ability. Fear can be conquered when you have a plan that you have built confidence in. As you gain time in the chair, confidence builds, and the plan will become easier and easier to follow. Stick with your plan and you will soon see that there is nothing to fear but fear itself.

We talked about the trick now onto the treat. I am pretty sure you have all seen gold lately. If we look at the weekly chart for gold it is looking beautiful. We were expecting a pull back after price got extended away from the MA’s, and we got it. Now price action looks like it might be presenting a buy setup on the weekly. We have already established a long-term Bullish bias for this commodity as we are inside a nice buy zone and inline with our bias on the monthly chart. If you do not trade the higher time frames you can go to your time-frame and find a good entry and stop-loss. If the trade triggers, like my last article touched on “just set it and forget it”.

Happy Halloween Traders.

Work Smarter Not Harder

I have said it before and I will say it again you cannot work harder or force progress to get more performance out of your strategy. If you try to work harder and force things you just fail more and dig yourself a deeper hole.

I know it sounds counter intuitive or even crazy to hear that too much market analysis can lead to over trading or analysis paralysis. But you would be surprised at how many traders struggle with this area in their trading. It is an inherent psychological trap that keeps many traders from ever reaching or achieving any real consistent success.

See humans have an innate need to feel in control of their life and of their surroundings, it is an evolutionary trait that has allowed our species to perpetuate its existence and ultimately arrive at our current modern-day level of civilization. Unfortunately for the aspiring market professional, this genetic trait of all human beings works against those trying to succeed at trading. In fact, most of our normal intuition of wanting to work harder or spend more time studying and researching for a project for work or school are instincts that are not beneficial to success in trading the markets.

Now there is absolutely nothing wrong with a little hard work, in fact in the real world I encourage it. But the issue with trying to apply the concept of hard work to trading is that beyond discipline, observation, patience and an ability to analysis and read charts, there really is no benefit to spending more time analyzing the same charts your already on top of or analyzing more economic news reports. At the end of the day we have no control over price movement and trying to further analyze economic data or trying to come up with an overly complicated method is essentially just a meaningless attempt to control something that simply cannot be controlled.

Thus, the main cause of trading failure begins with the traders psychological need to control their surroundings and when this emotional state meets the uncontrollable world of trading it almost always results in a loss of capital. To elaborate further this problem works to compound itself creating a ripple effect because once a trader loses a few trades he or she begins to get angry and starts revenge trading in an attempt to “get back” at the market. Once this process has begun it is very difficult to stop because it makes logical sense if things are not working out to put more time in and do more work to get better results. The difficult truth of the matter is that, after you have found a system that fits your trading style and you have reached a certain degree of technical and fundamental understanding, any further research or system “tweaking” beyond that point will only cripple you.

So how do we overcome this trading demon that has benefited us in the real world but has no place in our trading strategies. It is quite simple, if your trading edge is present then you execute your edge and do not involve yourself further in the process unless you have previously defined the action in your trading plan. In other words “Just set it and forget it”. When you decide to mess with or tweak your trade once you have already entered the market it almost always starts an emotional roller coaster that leads to moving your stop-loss further from your entry or getting rid of it entirely, moving your profit target further out, increasing your position size or over-trading. These actions almost always result in a loss of capital, because they were not objectively thought out, but were influenced by an emotional reaction that was caused by trying to control the uncontrollable.

Trading is more about timing than anything else. Timing is everything, you have to move to the markets rhythm. What that means is don’t fight the market take what it gives you when it decides to give it to you. Now how you react when the opportunity presents itself is paramount. Which brings us back to timing, are you entering the market at the right time, are you exiting your positions at the right time etc. Everything else in between are just extra thoughts and emotions that get in the way of your initial plan. Remember you cannot control the market but you can control yourself. In order to get more performance out of your strategy you must follow your trading plan. You must be rigid in your rules but flexible in your expectations.

Now onto the fun stuff. As you heard in my last newsletter Euro Swissy is about to get busy. If we look at the chart below it is apparent that we have a clearing bar from the Bulls after about 6 months of consolidation no that is not a typo yes 6 months of consolidation. This is such a big deal I have decided to shed light on this pair again. As traders it is our job to find out where the big money institutions are investing their money and follow suit. Since I have already established a long-term Bullish bias for you on this pair, this is a great opportunity to go to your time-frame find a good entry and stop-loss and “just set it and forget it”. If you follow the strategy in my last newsletter and execute properly you should be able to pull at least 700 pips from this position. Stay Tuned!

Risk to Reward

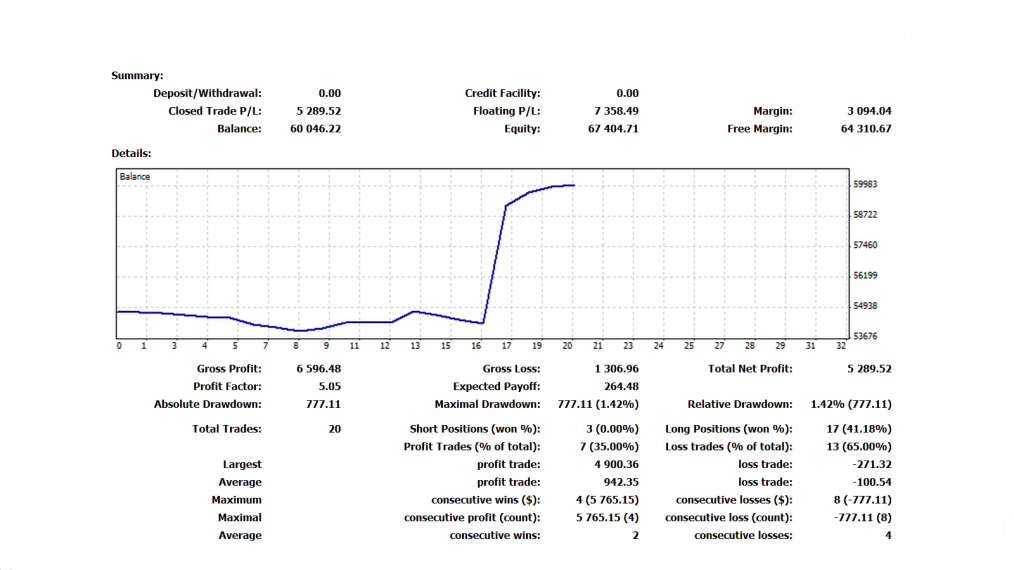

I have been so busy this week that I have not been able to trade my personal account much. But here is an update of where I am at as we approach the middle of the month.

If you notice my batting average has suffered severely because I have not been able to pay as much attention to my positions. But because I maintained a solid risk to reward on each position I have still been able to see consistent results. Stay Tuned!

GBP/CAD Daily Buy Setup

Ok it looks like GBP/CAD wants to play ball traders. Remember to wait for confirmation and not to jump the gun. Our entry at this point is at 1.56807 with our stop-loss below the bottoming tail at 1.55602. Since we are looking to risk 121 pips you should be looking to take profit at the prior high for TP1, & to the 20 MA on the weekly for TP2. With our last lot we will allow the chart to take us out of the trade by trailing either bar by bar pivot by pivot or by trailing a moving average. It is up to you to determine which trailing technique is best suited for the circumstances. Now remember since you are getting in the trade a little late you have to ask yourself is the risk to reward inline with my trading plan. If yes take the trade, if not pass on the trade because there will always be other opportunities. Stay tuned!

XAU: Respect is Earned

OMG! it looks like gold just does not want to quit. Looking back at one of my previous newsletters we anticipated a pull back on the daily chart to find an opportunity to add to our position. The chart below is a snap shot of price action on August 22nd when we projected the pull back.

Look at that we got our pull back and follow through on our buy setup. Not only did we got follow through traders but we even got a new high. Now that is what I am talking about!!!

You are probably wondering how I was able to project that price would not only pull back but eventually present another buy opportunity. The move we got from the bulls last week took a lot of buying power to establish. Buying power that could only come from big institutions. When you see big candles or moves that clear a lot of price action on the chart they demand your attention and command respect. On the chart below you can see how I have highlighted the powerful moves established by the bulls in side the grey areas and the buy zones that have been established based on these moves by the bulls inside the blue rectangle areas. A Buy Zone is the area from the prior low of a bullish candle or bullish move to the prior high. We typically look for pull backs to the 33% – 61.8% level inside the Buy Zone. (The same applies in reverse for a sell zone created by a move from the bears.)

Now that we understand how to identify a Buy and Sell zone, your probably asking yourself how to incorporate these zones in your trading. It is easier than you think. First you must make sure that your Buy Zone is inline with your higher time frames. If it is counter to your higher time frames then you want to make sure that there is enough upside potential to your next area of resistance. In other words you want to make sure your risk to reward is on point. Now inside a Buy Zone you will see all kind of attempts from the bears to wipe out what the bulls have established. But it is your job not to be fooled by these moves, instead you want to be patient and wait for a buy opportunity to present itself inside the Buy Zone. This can be applied to any time frame but keep in mind that the higher time frames are always going to carry more weight than the smaller ones. So that means that Buy Zones on the higher time frames are always going to be stronger than zones created on smaller time frames. Now Rule number 2 is a Buy Zone is still valid until it is wiped out from the bears completely. If you follow these few rules and respect these Zones by trading with them your trading profits will soar.

Bullish XAU: RingGOLD Hmm! I think my mother was on to something!!!

I am big trader of gold and a lot of other commodities mainly because of my political beliefs and knowledge on the banking system and the fiat currency that is used as a medium of exchange around the world. Another obvious reason is that it is apart of my family name. As I stated in previous Newsletters whenever I have an opportunity to go long Gold, Silver or Oil etc.. I hop on the opportunity as I believe long positions are inline with my long-term bias of gold reaching all time highs as it is a necessity in today’s society, and as central banks continue to print more and more money the result is higher gold prices in the long run. With all that being said it is obvious that price has been consolidating in an ascending triangle on our Daily gold chart. The weekly chart is very promising as we have had several bottoming tails that have formed since the beginning of May. Now we are officially above the weekly 20ma and our bias has shifted to the upside on the weekly chart. With the monthly inline with our long bias and coming off of a bottoming tail that bounced off of a rising 20ma last month. OMG look out Gold is set to explode to the upside. You heard it hear and from me and my fellow colleague Jonathan Velez first GOLD IS SET TO EXPLODE so strap on your seat belts and get ready for the ride. Stay Tuned!!!

AUD/USD Trade Update (Up 264 pips)

I can’t forget about my good ole AUD/USD long position. We are up 264 pips at the moment and still got some good size on. Our stop-loss is at break even so we are trading with the houses money at this point. I am expecting a pull back so that I can add to my position. If price action fails to pullback, gives us a shallow retracement and then decides to rally, then be mindful of the resistance at the 1.06321 level stay tuned.

$&P 500 Trade Update were in the money!

Man what can I say S&P 500 has been a beast. I mean did we pick the right time to go all in or what. Our Long position and add has paid us handsomely. As stated earlier we were looking to take profit at the top of the channel as price makes its way into the prior high. We are up 600 points and counting and we still got some nice size on this position. I am looking to get light on my position at the prior high on the monthly. It is rare in trading to have a home run but I think it is safe to say we knocked this one out of the park. Stay Tuned!

On another note have you ever heard the saying strike while the irons hot, get to gettin while the gettin is good, ride the trend till the end, Milk it dry etc… Although it is best to ride the trend as long as you possibly can during any season in the markets. During the summer since good trades and solid trends are far and few between (except this week in the market oh boy) one has to try to take advantage of any trend you find and follow the money. That means ride the wave and add till you cannot add no more. Now of course you want to keep your risk in check, treat every trade separately even if they are on the same chart, and follow your trading plan. But if there is money staring you in the face on a particular pair or commodity then stick with that pair or commodity because if it is paying and the other pairs or charts are choppy then the instrument that is paying is the one that commands our attention. As you can see in the chart above I have played S&P in a major way as well as AUD this past month because these are the charts that commanded my attention. In directing my focus to these charts I was able to avoid the whip saw and choppiness in other pairs that would have more than likely resulted in me giving some profit back.