Blog Archives

Up 2,500 points this month

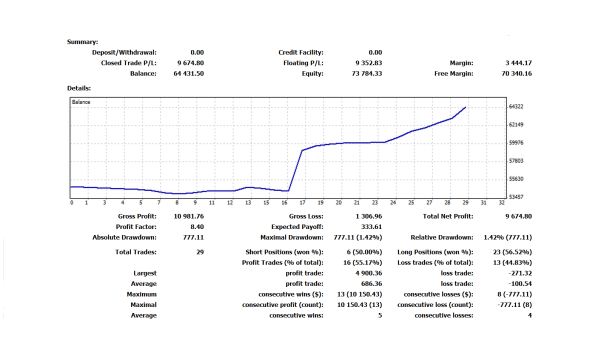

The market is back in full swing and we have been rewarded handsomely. In the last 24 hours I have had some nice gains and I am on track to another good month.

Perseverance goes a long way in this business. I started out this month from behind after losing 4 trades in a row and digging myself into a small hole. I continued to execute my plan and manged to make back my losses and then some. I have also brought my batting average back to a respectable level.

The best way to pull yourself out of a losing streak is to have amnesia when you approach new positions. You got to forget about the last trade and how much you made or lost and move on to the next trade. Every trade is different and you do not want your emotions spilling over to the next trade. This allows you to stay focused and execute your plan based on what you see is happening instead of your emotions taking over and dictating what you do.

$&P 500 Trade Update were in the money!

Man what can I say S&P 500 has been a beast. I mean did we pick the right time to go all in or what. Our Long position and add has paid us handsomely. As stated earlier we were looking to take profit at the top of the channel as price makes its way into the prior high. We are up 600 points and counting and we still got some nice size on this position. I am looking to get light on my position at the prior high on the monthly. It is rare in trading to have a home run but I think it is safe to say we knocked this one out of the park. Stay Tuned!

On another note have you ever heard the saying strike while the irons hot, get to gettin while the gettin is good, ride the trend till the end, Milk it dry etc… Although it is best to ride the trend as long as you possibly can during any season in the markets. During the summer since good trades and solid trends are far and few between (except this week in the market oh boy) one has to try to take advantage of any trend you find and follow the money. That means ride the wave and add till you cannot add no more. Now of course you want to keep your risk in check, treat every trade separately even if they are on the same chart, and follow your trading plan. But if there is money staring you in the face on a particular pair or commodity then stick with that pair or commodity because if it is paying and the other pairs or charts are choppy then the instrument that is paying is the one that commands our attention. As you can see in the chart above I have played S&P in a major way as well as AUD this past month because these are the charts that commanded my attention. In directing my focus to these charts I was able to avoid the whip saw and choppiness in other pairs that would have more than likely resulted in me giving some profit back.

To Speculate? Or Spectate? That is the question

As traders gain more time in the chair they are faced with different challenges. A new trader tends to want to overtrade or are hesitent in their execution, because of a lack of experience and the short time spent back testing their strategy. While the obstacles that many veterans face is getting complacent and over confident after a consecitive series of winning trades.

The seasoned trader’s ability to recognize a buy or sell setup doesn’t mean that they should always take the setup. Knowing when to trade and when to stay on the sidelines in cash is paramount to a traders success. Developing ways to minimize the number of premature trades taken will undoubtedly increase your bottom line.

There are times when there are opportunities all around us, & then there are times like this week when things are really overbought or oversold and require patience from the trader to wait until price action presents the right event at the right location.

Notice how on this Weekly EUR/GBP chart we have several red bars to the downside with alot separation from price action and the moving averages. Neither the bulls nor the bears can sustain a continued move in one direction before the other side tries to flex their muscles and show their strength in attemps to reverse the current trend. With that being said we can expect to see a possible correction up to .81439. This current price action could present a opportunity to gain 118 pips by taking a long position above the bottoming tail with an initial target into the 8MA.

If you have not already done so you should impliment stop gaps in your trading plan to address overtrading. Developing a sense of discipline around the number of trades you take on a daily basis will not only give you peace of mind but will also bring more consistent results in your trading.